Planning for retirement is one of the most important financial decisions you will make in your lifetime, and understanding the Social Security retirement age is a critical part of that process.

Social Security provides a safety net for millions of Americans, offering monthly benefits to support individuals after they stop working.

However, the age at which you choose to claim these benefits can have a significant impact on the amount you receive over your lifetime.

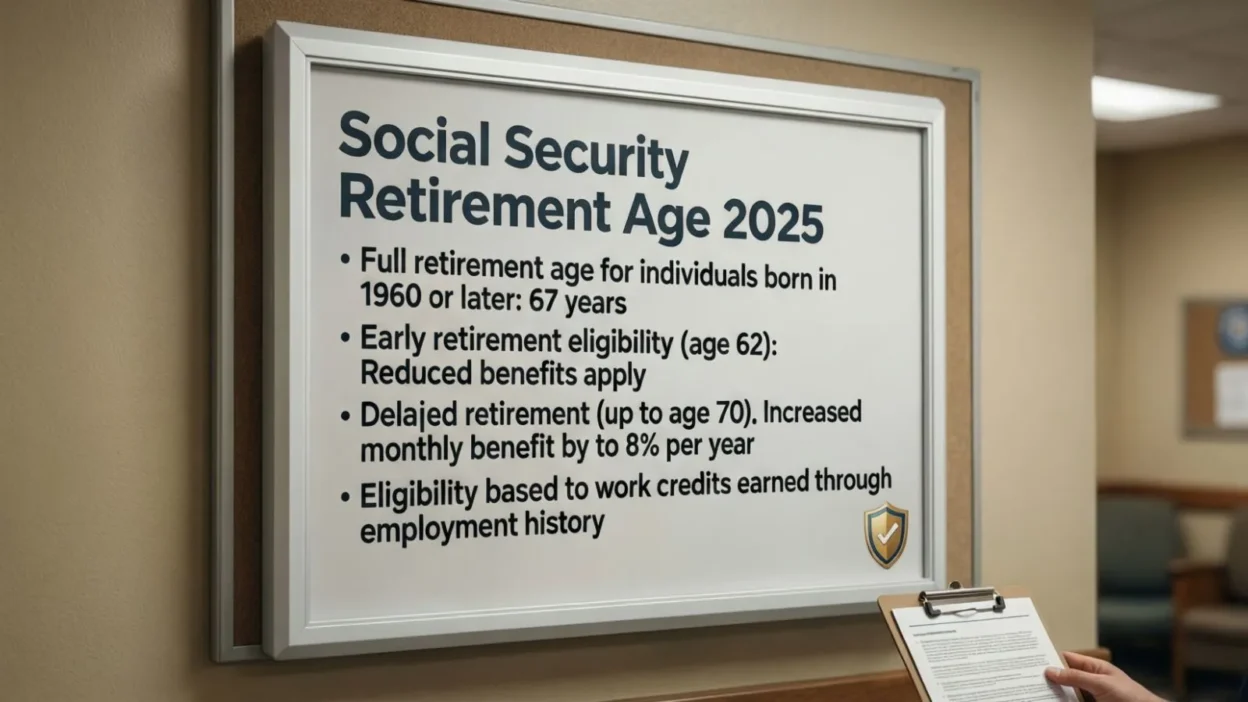

In 2025, Social Security rules and full retirement ages (FRA) continue to evolve, reflecting changes in life expectancy and legislation.

If you are considering early retirement at 62, waiting until your full retirement age, or delaying benefits until 70, knowing the specifics for 2025 can help you make informed decisions.

In this article, we will explore the Social Security retirement age for 2025, how benefits are calculated, and strategies to maximize your retirement income.

Understanding Social Security Retirement Age

The Social Security retirement age is the age at which you become eligible to receive your full Social Security retirement benefits. This age is often referred to as the Full Retirement Age (FRA) and varies depending on the year you were born. Understanding this concept is essential because claiming benefits before or after your FRA can significantly impact the monthly amount you receive.

For those who choose to retire early, the minimum age to claim benefits is 62. However, claiming Social Security before your FRA results in permanently reduced benefits. On the other hand, delaying benefits beyond your FRA can increase your monthly payments thanks to delayed retirement credits, which accumulate until you reach age 70.

The FRA gradually increases over time due to changes in Social Security law designed to account for longer life expectancies. For example, individuals born in 1960 or later have a FRA of 67, while those born earlier may have an FRA between 65 and 66.

It is also important to note that Social Security benefits are not just based on age—they depend on your lifetime earnings and contributions to the system. Planning your retirement strategy around the FRA ensures you receive the maximum possible benefit while balancing your personal financial needs, health, and lifestyle goals.

By understanding the Social Security retirement age, you can make informed decisions about when to claim benefits and how to structure your retirement for long-term financial security.

Social Security Retirement Age in 2025

In 2025, understanding the Social Security retirement age is crucial for anyone planning their retirement. The Full Retirement Age (FRA) depends on your birth year, and it determines when you are eligible to receive 100% of your Social Security benefits. For most individuals approaching retirement in 2025, the FRA ranges from 66 to 67 years, depending on their birth year.

For example, people born in 1959 will reach their FRA at 66 and 10 months, while those born in 1960 or later will have a FRA of 67. This gradual increase in retirement age reflects changes made by Social Security amendments to account for longer life expectancies.

While 62 remains the earliest age to claim Social Security, benefits claimed before your FRA will be permanently reduced. Conversely, delaying benefits past your FRA can increase your monthly payments through delayed retirement credits, which grow until age 70.

It’s important to note that Social Security also adjusts benefits each year based on cost-of-living adjustments (COLA), which can slightly increase your payouts. Knowing your exact FRA in 2025 allows you to plan effectively, whether you are considering early retirement, full benefits, or delayed claiming.

By understanding the FRA for 2025 and how it affects your benefits, you can make informed decisions that maximize your retirement income, align with your financial goals, and ensure greater long-term security.

Early vs. Delayed Retirement: Pros and Cons

When planning for Social Security benefits, one of the most important decisions is whether to retire early, at your full retirement age (FRA), or delay retirement. Each option comes with distinct advantages and trade-offs, impacting your monthly benefits and overall financial security.

Early Retirement allows you to claim Social Security benefits as early as age 62, providing access to funds sooner. This can be beneficial for individuals who need income immediately, are in poor health, or plan to reduce work hours. However, claiming benefits early comes with a permanent reduction in monthly payments. For example, someone with an FRA of 67 may see their benefits reduced by up to 30% if they retire at 62.

Full Retirement Age (FRA) offers the full benefit amount without reductions. Retiring at FRA is ideal for those who can continue working until that age, allowing them to maximize their lifetime benefits while balancing work and personal life.

Delayed Retirement occurs when you choose to postpone benefits beyond your FRA, up to age 70. This strategy increases monthly benefits through delayed retirement credits, which can boost payments by 8% per year past your FRA. Delaying retirement is advantageous for healthy individuals expecting to live longer, as it increases long-term income and provides financial security later in life.

Ultimately, the choice between early and delayed retirement depends on financial needs, health, lifestyle goals, and life expectancy. Understanding the pros and cons of each option allows you to make an informed decision, ensuring that your Social Security benefits support your retirement plans effectively.

How Social Security Benefits Are Calculated

Social Security benefits are not a fixed amount—they are carefully calculated based on your earnings history, age at retirement, and adjustments for inflation. Understanding how these benefits are determined is crucial for planning an effective retirement strategy.

The Social Security Administration (SSA) uses a formula called the Primary Insurance Amount (PIA) to calculate your monthly benefit at full retirement age. First, your lifetime earnings are indexed to account for wage growth, creating your Average Indexed Monthly Earnings (AIME). Then, the SSA applies a tiered formula to the AIME to determine your PIA. This ensures that lower-income workers receive a proportionally higher benefit relative to their earnings, while higher earners have a capped payout.

Your age at claiming also significantly impacts your benefits. Claiming before your full retirement age reduces your monthly payment, while delaying benefits past your FRA increases your monthly payout due to delayed retirement credits. Benefits can grow by approximately 8% per year for each year you delay until age 70.

Additionally, Social Security benefits are adjusted annually through cost-of-living adjustments (COLA) to protect against inflation, which slightly increases payments over time.

To estimate your benefits, the SSA offers online retirement calculators and personalized statements, which can help you plan when to claim for maximum income. By understanding how benefits are calculated, you can make informed decisions that align your Social Security income with your overall retirement strategy.

Planning for Retirement in 2025

Planning for retirement in 2025 requires careful consideration of your Social Security benefits, personal savings, and overall financial strategy. Knowing your Full Retirement Age (FRA) and how it affects monthly benefits is the first step in making informed decisions about when to claim Social Security.

One key strategy is to determine the optimal claiming age. While some individuals may need to retire early at 62, others may benefit from delaying benefits until age 70 to maximize monthly income. This is especially important for individuals in good health who anticipate a longer life expectancy.

In addition to Social Security, it is essential to supplement your retirement income with other savings, such as 401(k)s, IRAs, and personal investments. Relying solely on Social Security may not provide enough income to maintain your desired lifestyle. Diversifying income sources can help cover expenses like healthcare, housing, and daily living costs.

Another important factor is working while receiving benefits. Individuals who continue working before reaching FRA may temporarily see a reduction in Social Security benefits due to the earnings test, but once FRA is reached, benefits are recalculated to account for months of withheld payments.

Finally, use planning tools and calculators provided by the Social Security Administration to estimate benefits and explore different scenarios. By combining careful planning, diversified savings, and informed decision-making, you can ensure that your retirement in 2025 is financially secure and aligned with your lifestyle goals.

Social Security Changes and Updates in 2025

Every year, Social Security benefits are adjusted to reflect economic changes, and 2025 is no exception. Staying informed about these updates is essential for accurate retirement planning and maximizing your benefits. One of the most notable annual changes is the cost-of-living adjustment (COLA), which is designed to help Social Security payments keep pace with inflation. In 2025, beneficiaries can expect a slight increase in monthly payments, which helps offset rising living costs, including healthcare, housing, and daily expenses.

Another important update involves Social Security retirement age adjustments. While the Full Retirement Age (FRA) continues to gradually increase for individuals born in 1960 or later, there are no major legislative changes expected to drastically alter eligibility. This gradual adjustment ensures that Social Security remains sustainable for future generations while reflecting longer life expectancies.

Additionally, 2025 may bring updates to earnings limits for individuals claiming benefits before FRA. Those who work while receiving Social Security before reaching FRA may have a portion of their benefits temporarily withheld if their earnings exceed the annual limit. These withheld benefits are not lost; they are recalculated when the individual reaches FRA to ensure they receive the full entitled benefit.

It is also important to monitor any policy changes or proposals affecting Social Security funding and benefit calculations, as these can influence long-term planning. By staying informed about 2025 updates, individuals can make strategic decisions about when to claim benefits, how to supplement income, and how to secure financial stability throughout retirement.

Common Questions About Social Security Retirement Age

1. Can I retire at 62 and still work?

Yes, you can claim Social Security as early as 62, even if you continue working. However, your benefits may be temporarily reduced if your earnings exceed the annual limit before reaching your Full Retirement Age (FRA). Once you reach FRA, the SSA recalculates your benefits to account for any withheld amounts.

2. What happens if I delay retirement past my FRA?

Delaying benefits beyond your FRA increases your monthly payment through delayed retirement credits, which grow roughly 8% per year until age 70. This strategy can be beneficial if you expect a longer life expectancy or want higher guaranteed income later in retirement.

3. How are Social Security benefits affected by inflation?

Social Security benefits are adjusted annually through cost-of-living adjustments (COLA) to help offset inflation. This ensures that your purchasing power is maintained even as prices for goods and services increase over time.

4. Can divorced individuals receive benefits?

Yes, divorced individuals may be eligible to claim benefits based on a former spouse’s earnings history, provided the marriage lasted at least ten years.

5. How do I know my exact retirement age in 2025?

Your Full Retirement Age is based on your birth year. The SSA provides online calculators and personalized statements to help you determine your exact FRA and projected benefits.

Case Studies / Examples

Understanding Social Security benefits can be easier when looking at real-life scenarios. Let’s consider a few examples for individuals planning to retire in 2025.

Case Study 1: Early Retirement

Jane is 62 in 2025 and chooses to claim Social Security immediately. Her Full Retirement Age (FRA) is 67, and her estimated monthly benefit at FRA is $2,000. By claiming early, Jane’s benefits are reduced by approximately 30%, meaning she receives $1,400 per month. While this provides immediate income, it results in permanently lower monthly payments for the rest of her life.

Case Study 2: Full Retirement Age

Mark, also in 2025, waits until his FRA of 67 to claim benefits. His monthly payment is $2,000, the full benefit amount. By waiting, he avoids any reductions and secures stable income without needing to adjust his lifestyle.

Case Study 3: Delayed Retirement

Sarah decides to delay claiming Social Security until age 70. Her FRA is 67, and by waiting three extra years, she earns delayed retirement credits, increasing her monthly benefit by about 24%. Her monthly payment grows from $2,000 to $2,480, providing higher long-term income and additional financial security in later years.

Tools and Resources

Planning for retirement in 2025 requires reliable tools and resources to help you estimate Social Security benefits, understand your options, and make informed decisions. The Social Security Administration (SSA) provides a variety of resources that are essential for anyone approaching retirement.

One of the most useful tools is the SSA’s online Retirement Estimator, which allows you to calculate your projected benefits based on your actual earnings record. This tool can help you explore different scenarios, such as claiming benefits early, at Full Retirement Age (FRA), or delaying until age 70. By inputting your information, you can see how each choice affects your monthly benefit and lifetime income.

The SSA also provides personalized Social Security statements, which give a detailed history of your earnings, your estimated benefits at different claiming ages, and how your benefits may change with cost-of-living adjustments (COLA). These statements are updated annually and can serve as a foundation for retirement planning.

Additionally, there are third-party tools and financial calculators designed to help you plan your retirement comprehensively. These include tools for 401(k), IRA, and other retirement savings projections, allowing you to see how Social Security fits into your overall financial strategy.

Finally, consulting with a financial advisor or retirement planner can provide personalized guidance, especially for complex situations like divorce benefits, spousal benefits, or managing multiple income streams. By combining online calculators, SSA tools, and professional advice, you can confidently plan your retirement in 2025 and make decisions that maximize your Social Security benefits.

FAQs About Social Security Retirement Age 2025

1. What is the full retirement age for Social Security in 2025?

The Full Retirement Age (FRA) depends on your birth year. Most individuals turning retirement age in 2025 will have an FRA between 66 and 67. People born in 1960 or later have a FRA of 67.

2. Can I claim Social Security benefits before my full retirement age?

Yes, you can claim benefits as early as 62, but your monthly payments will be permanently reduced. The earlier you claim, the smaller the monthly benefit.

3. What are delayed retirement credits?

If you delay claiming benefits past your FRA, your monthly payment increases by approximately 8% per year until age 70. This can significantly boost long-term retirement income.

4. How are benefits calculated?

Benefits are based on your lifetime earnings, adjusted for inflation, using a formula called the Primary Insurance Amount (PIA). The SSA also considers cost-of-living adjustments (COLA) to maintain purchasing power.

5. Can I work while receiving Social Security benefits?

Yes, but if you claim benefits before FRA and earn above a certain limit, a portion of your benefits may be temporarily withheld. Once you reach FRA, your benefits are recalculated to account for withheld amounts.

6. Are there special rules for divorced or spousal benefits?

Yes, eligible divorced individuals or spouses may claim benefits based on their partner’s earnings record if certain conditions are met, such as marriage length and age.

7. How do I know my exact benefit for 2025?

The SSA provides personalized statements and online calculators to estimate benefits at different claiming ages, helping you plan effectively for retirement.

Conclusion:

Understanding the Social Security retirement age in 2025 is a critical step in planning for a financially secure retirement.

The Full Retirement Age (FRA) varies depending on your birth year, typically ranging from 66 to 67 for those approaching retirement in 2025.

Knowing your FRA allows you to make informed decisions about when to claim benefits, whether to retire early, at full age, or delay for higher monthly payments.

Early retirement at age 62 provides immediate income but results in permanently reduced benefits, while delaying past your FRA can significantly increase monthly payments through delayed retirement credits.

Each option has advantages and trade-offs, depending on your financial needs, health, and lifestyle goals.

By examining real-life examples and understanding how benefits are calculated including the impact of lifetime earnings, cost-of-living adjustments (COLA), and the Primary Insurance Amount (PIA) you can better plan your retirement strategy.

Planning ahead also involves leveraging the tools and resources provided by the Social Security Administration, including online calculators, personalized statements, and planning guides.

Additionally, supplementing Social Security with personal savings, 401(k) accounts, IRAs, and professional financial advice can further enhance your retirement security.

Ultimately, the key to maximizing Social Security benefits in 2025 is knowledge and strategic planning.

By understanding your retirement age, exploring different claiming options, and using available resources, you can ensure a comfortable and stable retirement while making the most of the benefits you have earned over your working life.

Jonathan Bishopson is the punmaster-in-chief at ThinkPun.com, where wordplay meets wit and every phrase gets a clever twist. Known for turning ordinary language into laugh-out-loud lines, Jonathan crafts puns that make readers groan, grin, and think twice. When he’s not busy bending words, he’s probably plotting his next “pun-derful” masterpiece or proving that humor really is the best re-word.